On December 31, 2024, BlackRock, Inc. (Exchanges, Portfolio) executed a striking exchange including Texas Pacific Land Corp (TPL, Monetary), lessening its property by 464,822 offers. This move addresses a 20.39% diminishing in BlackRock’s situation in TPL. In spite of this decrease, TPL stays a critical piece of BlackRock’s portfolio, comprising 7.90% of its possessions in the stock. The exchange was completed at a cost of $1,105.96 per share, and from that point forward, TPL’s stock cost has ascended to $1,394.32, denoting a 26.07% increase.

BlackRock, Inc. (Exchanges, Portfolio): A Profile of the Venture Monster

BlackRock, Inc. (Exchanges, Portfolio), settled at 50 Hudson Yards, New York, NY, is a main venture company with a noteworthy value of $4,761.16 trillion. Known for venture reasoning underscores expansion and long haul development, BlackRock stands firm on significant footings in significant innovation organizations like Apple Inc (AAPL, Monetary) and Amazon.com Inc (AMZN, Monetary). The company’s essential spotlight on innovation and monetary administrations areas highlights its obligation to putting resources into high-development regions.

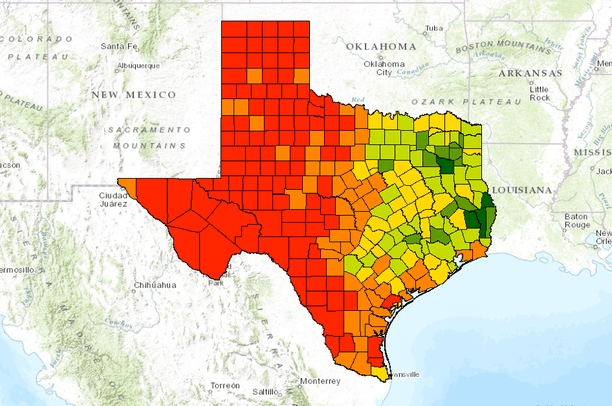

Grasping Texas Pacific Land Corp

Texas Pacific Land Corp, situated in the USA, is an unmistakable player in the oil and gas industry. The company essentially participates in land deals, rents, and oil and gas eminences, working through its Land and Asset The board and Water Administrations and Activities sections. With a market capitalization of $32.03 billion, TPL brags areas of strength for a Position 9/10, mirroring its powerful monetary presentation and functional effectiveness.

Investigating the Exchange

The exchange’s execution at $1,105.96 per share, contrasted with the ongoing stock cost of $1,394.32, shows a huge increase of 26.07%. Notwithstanding the decrease in shares, TPL keeps on being an essential interest for BlackRock, containing 7.90% of its property in the stock. This choice might mirror an essential portfolio change, conceivably impacted by TPL’s ongoing valuation and economic situations.

Monetary Measurements and Valuation

Texas Pacific Land Corp is right now thought to be fundamentally exaggerated, with a GF Worth of $715.39 and a Cost to GF Worth proportion of 1.95. The stock’s GF Score is 80/100, recommending likely normal execution. TPL’s solid development measurements, including a 32.50% profit development north of three years, support its monetary strength and potential for future development.

Market Setting and Area Execution

Working in the oil and gas area, TPL has encountered hearty development, with a 28.20% income development north of three years. The company’s accounting report and benefit positions are high, at 9/10, showing monetary solidness and functional effectiveness. TPL’s Development Position of 10/10 further features major areas of strength for its in the business.

Premium from Other Outstanding Financial backers

Other than BlackRock, other unmistakable financial backers in TPL incorporate Joel Greenblatt (Exchanges, Portfolio), Ken Fisher (Exchanges, Portfolio), and Jefferies Gathering (Exchanges, Portfolio). GAMCO Financial backers holds the biggest offer rate, highlighting TPL’s engaging quality on the lookout. This different premium from different trading companies features the company’s true capacity and market claim.

Summary

BlackRock’s choice to diminish its stake in Texas Pacific Land Corp mirrors an essential portfolio change, conceivably impacted by the stock’s ongoing valuation and economic situations. This exchange features the powerful idea of speculation systems among driving firms and the significance of persistent market assessment. As TPL keeps on performing great in the oil and gas area, it stays a huge premium for financial backers looking for development and productivity.

This article, produced by GuruFocus, is intended to give general experiences and isn’t custom fitted monetary counsel. Our critique is established in authentic information and expert projections, using a fair philosophy, and isn’t expected to act as unambiguous speculation direction. It doesn’t form a suggestion to buy or strip any stock and doesn’t think about individual venture goals or monetary conditions. Our goal is to convey long haul, principal information driven investigation. Know that our investigation probably won’t incorporate the latest, cost delicate company declarations or subjective data. GuruFocus stands firm on no foothold in the stocks referenced in this.